Daily Market Update: 28 August, 2025

The key takeaways from the last 24 hours

Australian market

The Australian sharemarket edged higher on Wednesday as the S&P/ASX 200 Index (ASX: XJO) rose 24.90 points, or 0.3 per cent. This comes after the trimmed mean inflation figure hit 2.7 per cent in the year to July, the reading exceeded expectations and dampened the likelihood of a September rate cut, with odds shrinking to 22 per cent from 37 per cent, while a November reduction remains fully priced in. The S&P/ASX 200 Index (ASX: XJO) rally was broad‑based, led by lithium miners on UBS’s upgraded forecasts, with Liontown Resources Limited (ASX: LTR) surging 9.5 per cent to 92 cents, Pilbara Minerals Limited (ASX: PLS)up 8.8 per cent to $2.34, and Mineral Resources Limited (ASX: MIN) rising 6.8 per cent to $37.45. BHP Group Limited (ASX: BHP) and Rio Tinto Limited (ASX: RIO) also climbed about 1 per cent. Consumer staples dragged, with Woolworths Group Limited (ASX: WOW) tumbling 14.7 per cent to $28.51 after a profit downgrade and dividend cut, while WiseTech Global Limited (ASX: WTC) dropped 11.9 per cent on softer-than-expected results. Meanwhile, Domino’s Pizza Enterprises Limited (ASX: DMP) plunged 22 per cent on concerns over weak cash flows.

Australian corporate highlights

Among standout movers, Tabcorp Holdings Limited (ASX: TAH) soared 23.9 per cent to 88 cents after returning to net profit and unveiling over A$40 million in cost reductions alongside new product launches. Lovisa Holdings Limited (ASX: LOV) rose 13.2 per cent to $41.23 with stronger-than-expected sales and cost performance. Worley Limited (ASX: WOR) gained 11 per cent to $14 on better margins and a moderately optimistic outlook. Sigma Healthcare Limited (ASX: SIG) advanced 7.8 per cent to $3.04 after announcing management changes and posting a 41 per cent jump in profits. Meanwhile, Nine Entertainment Co. Holdings Limited (ASX: NEC) rose 7.9 per cent to $1.84 after declaring a A$0.49‑per‑share special dividend totaling about A$780 million from the sale of its stake in Domain Holdings Australia Limited (ASX: DHG). Additionally, SiteMinder Limited (ASX: SDR) rocketed 21.1 per cent to $6.60, buoyed by early traction from new products and strong adoption of its Smart Platform.

All eyes on Nvidia earnings

Nvidia Corporation (NASDAQ: NVDA) reported better‑than‑expected second‑quarter earnings and revenue on Wednesday, with adjusted earnings per share of $1.05 and revenue of US $46.74 billion beating forecasts, though data center revenue fell slightly short of Wall Street estimates, causing its stock to slip in after‑hours trading despite launching a US $60 billion stock buyback and projecting strong third‑quarter guidance. Meanwhile, the restoration of Cracker Barrel’s original logo following criticism from President Donald Trump, who publicly urged the company to ditch its rebrand drew political attention and reaffirmed the power of cultural influence in business decisions the president has on companies.

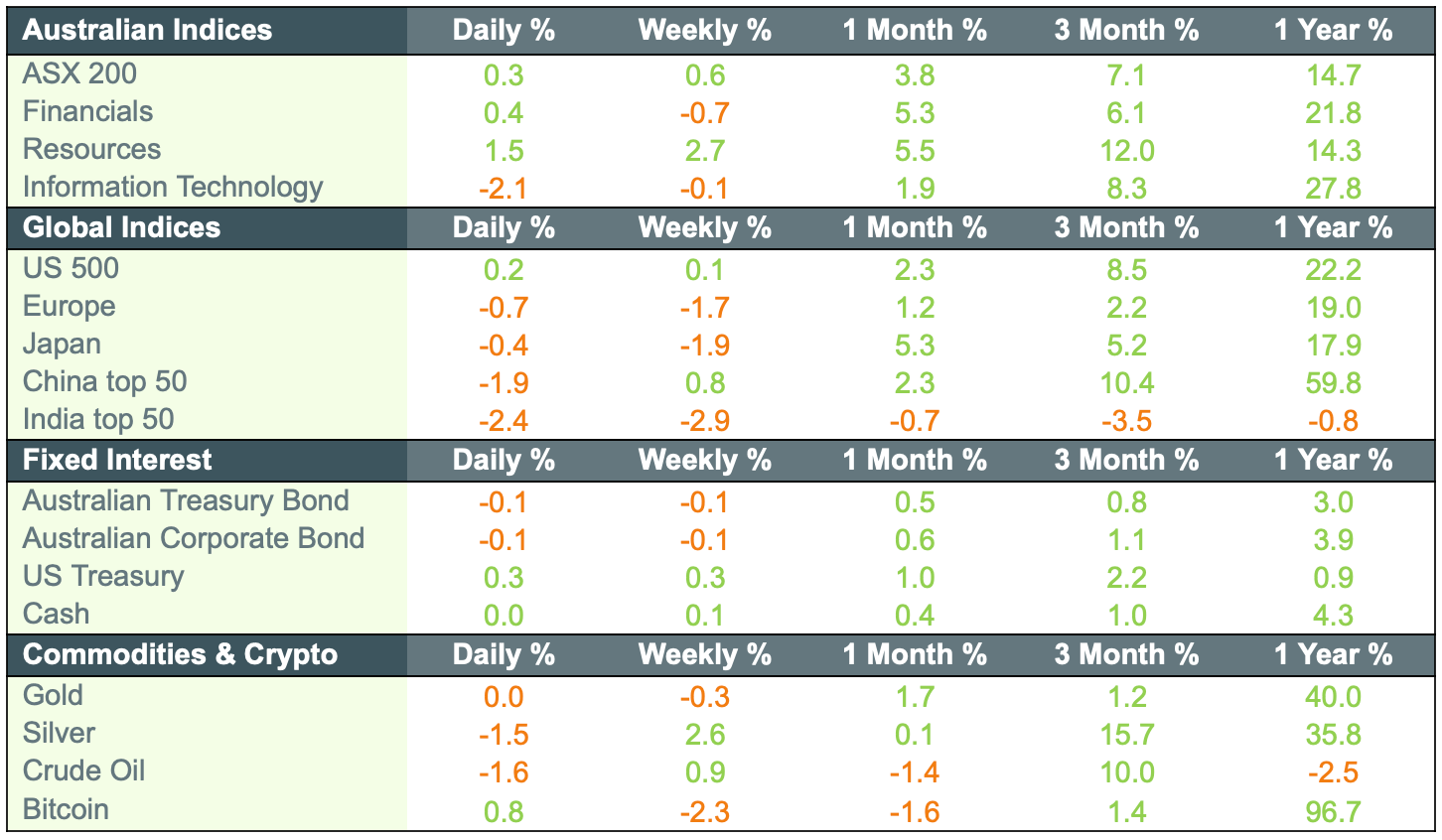

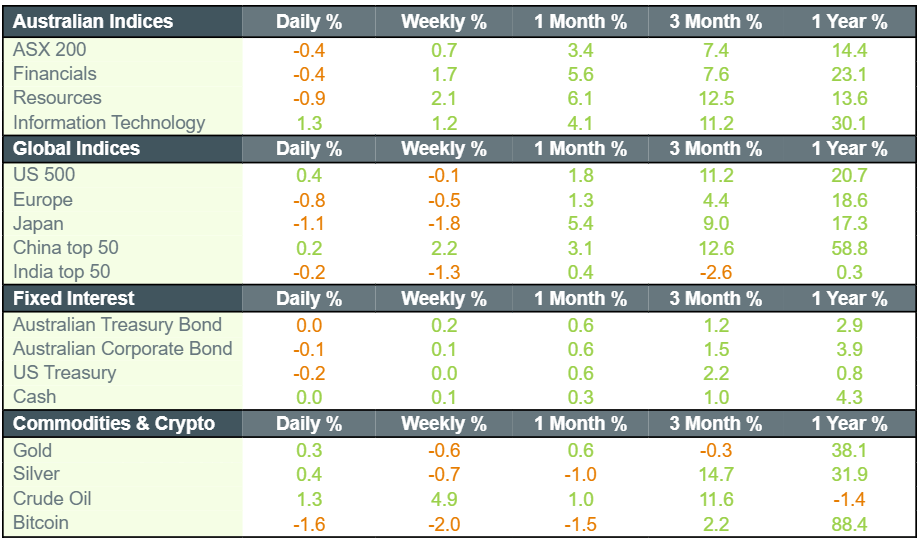

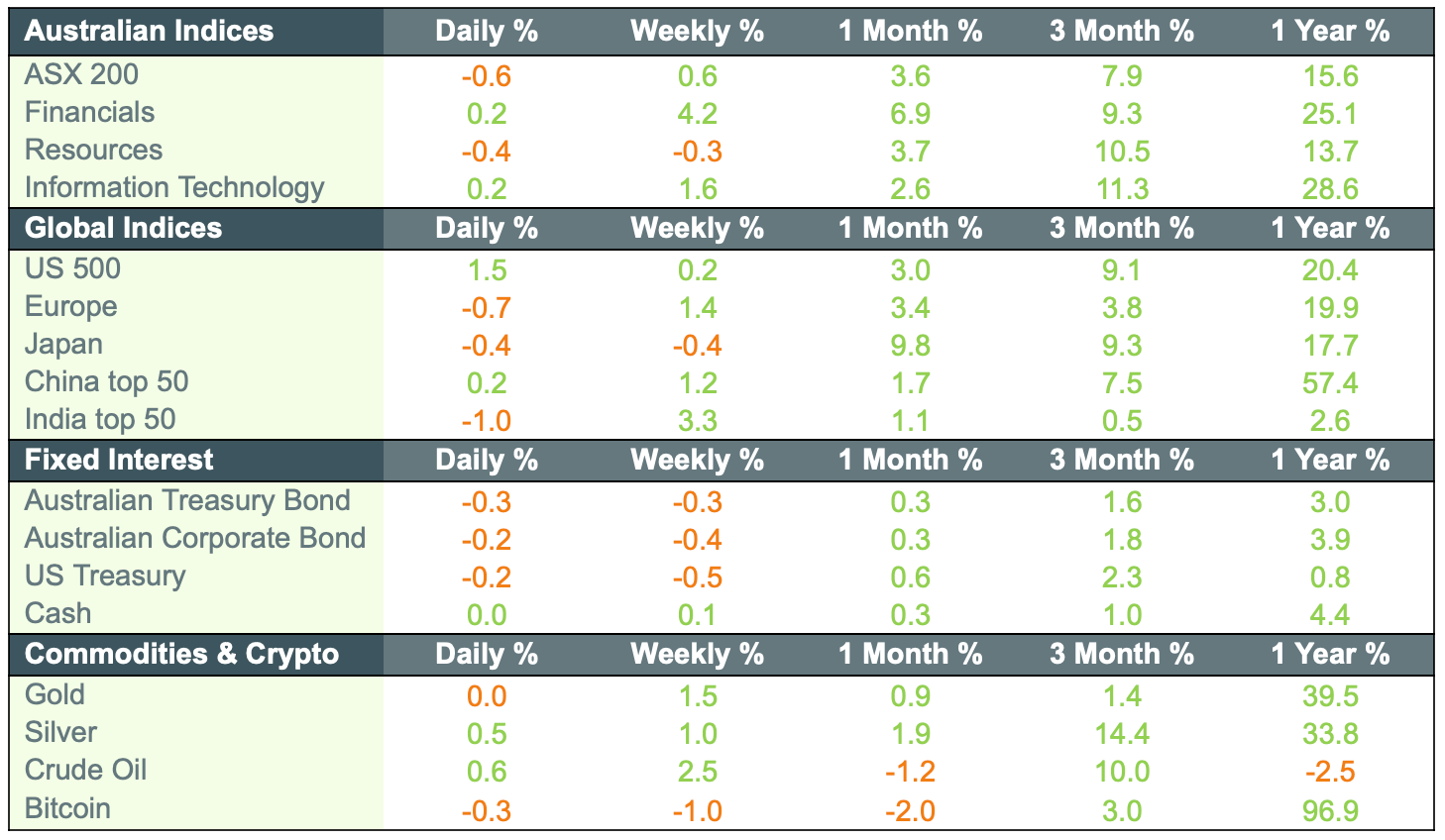

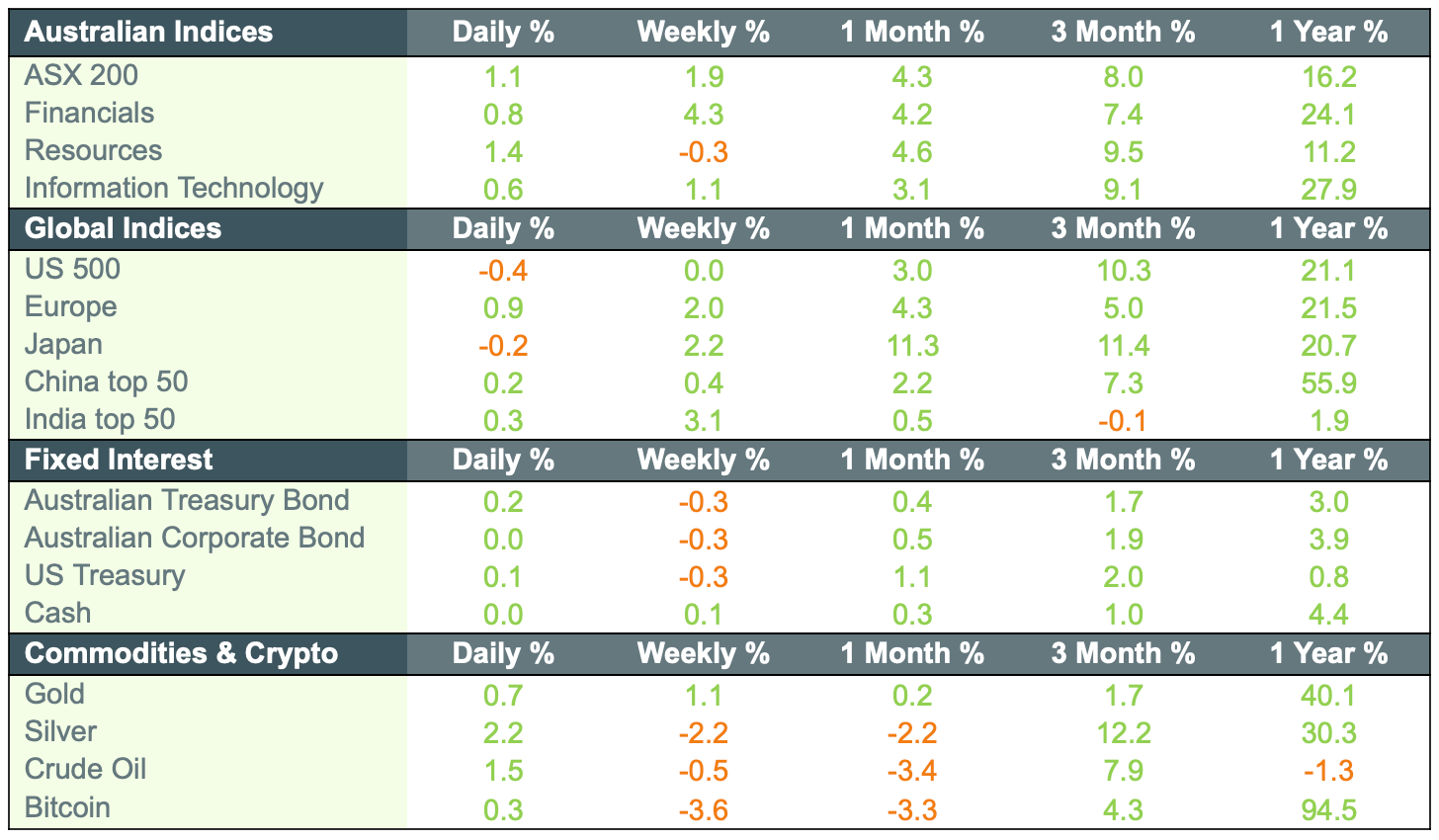

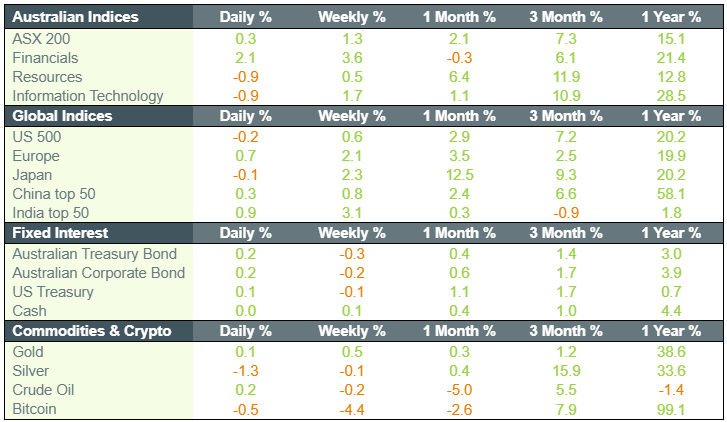

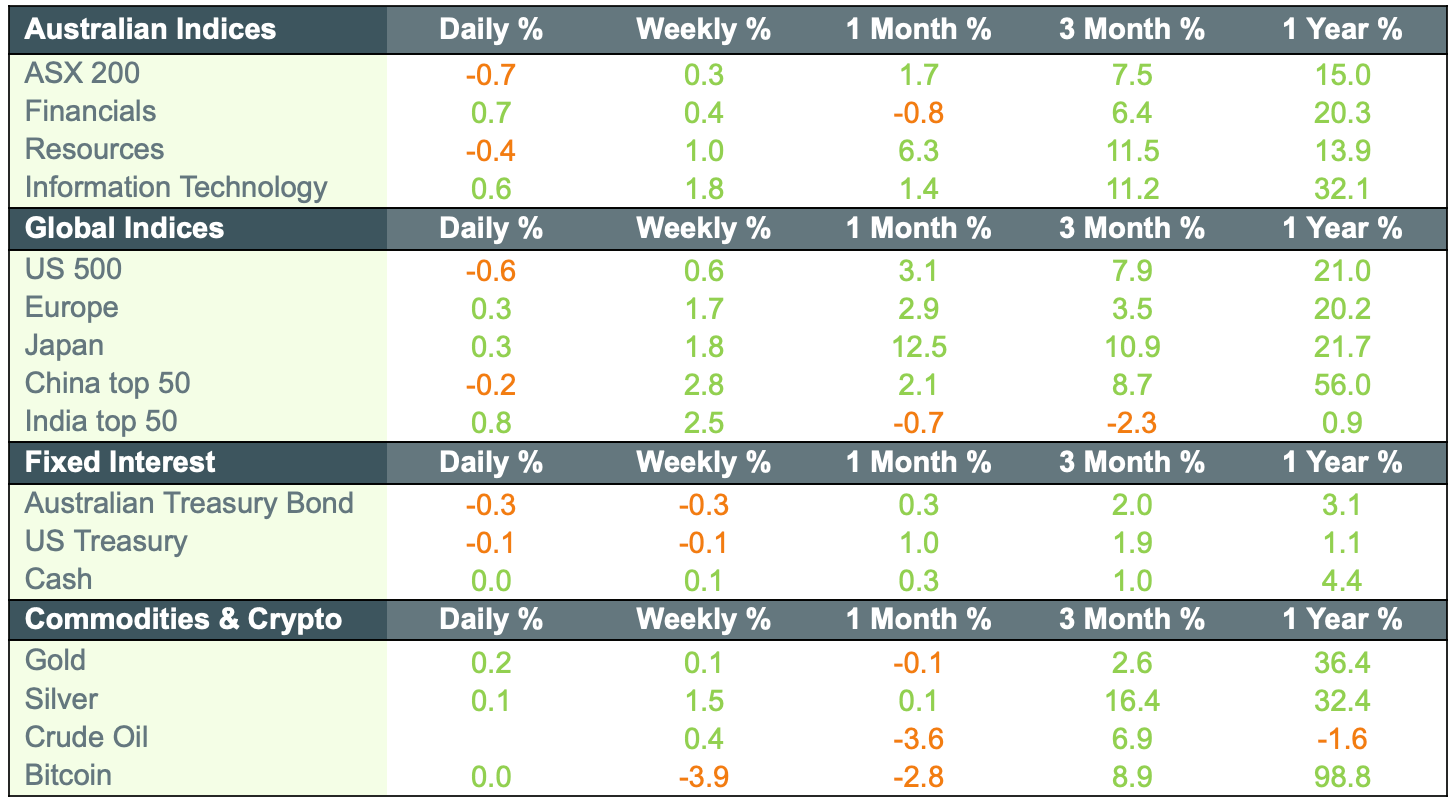

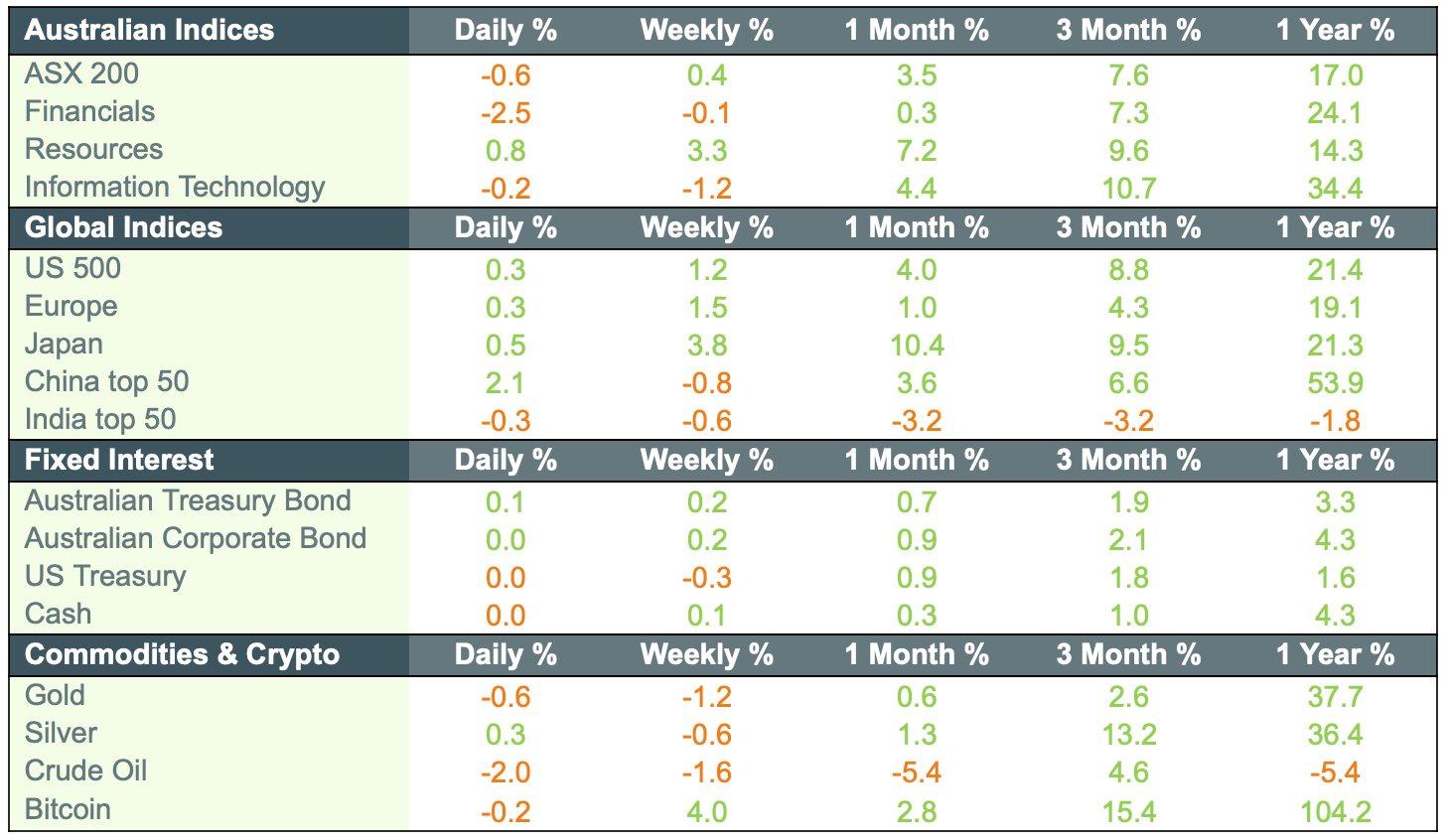

Market movements