Daily Market Update: 13 August, 2025

The key takeaways from the last 24 hours

Australian market hits fresh record

The Australian sharemarket closed at a record high on Tuesday after the Reserve Bank of Australia unanimously cut interest rates for the third time this year, lowering the cash rate to 3.6 per cent – its lowest level in more than two years. The S&P/ASX 200 Index (ASX: XJO) rose 36 points, or 0.4 per cent, to 8880.80, surpassing last week’s record of 8848.80. Gains were led by financials, with ANZ Group Holdings Limited (ASX: ANZ) up 2.2 per cent to $31.93, National Australia Bank Limited (ASX: NAB) up 1 per cent to $39.19, Westpac Banking Corporation (ASX: WBC) up 0.9 per cent to $34.63, and Commonwealth Bank of Australia (ASX: CBA) up 0.1 per cent to $178.80.

Sectors and companies in focus

Retail stocks advanced on expectations that reduced mortgage costs would boost consumer spending, with JB Hi-Fi Limited (ASX: JBH) gaining 5.6 per cent to $113.85 after a Macquarie upgrade, and Breville Group Limited (ASX: BRG) up 1.3 per cent to $35.24. Materials also rallied as iron ore futures rose to $US104.80 per tonne, pushing Fortescue Metals Group Limited (ASX: FMG) up 1.2 per cent to $19.66, Rio Tinto Limited (ASX: RIO) up 1.2 per cent to $116.72, and BHP Group Limited (ASX: BHP) up 1 per cent to $41.26. Life360 Inc. (ASX: 360) was the day’s top gainer, surging 7.8 per cent to $40.77 after upgrading full-year guidance. Declines came from Seven Group Holdings Limited (ASX: SVW), down 8.5 per cent to $47.45, Brambles Limited (ASX: BXB), down 1.5 per cent, and Atlas Arteria Group (ASX: ALX), down 1.3 per cent.

Global markets rally on US inflation data

Wall Street advanced strongly after US inflation data met expectations, easing concerns over rising prices. The S&P 500 Index (NYSE: SPX) rose 1.1 per cent and the Nasdaq Composite Index (NASDAQ: IXIC) gained 1.4 per cent, both setting record highs, while the Dow Jones Industrial Average (NYSE: DJI) added 483 points. Investors increased bets on a US Federal Reserve rate cut in September, with odds at 90 per cent for a 25-basis-point reduction. Gains were supported by easing US–China trade tensions after President Trump extended a tariff pause, and by strong earnings from companies such as Intel Corporation (NASDAQ: INTC) up 5.5 per cent, Meta Platforms Inc. (NASDAQ: META) up 3.1 per cent, and Alphabet Inc. (NASDAQ: GOOGL) up 1.2 per cent. US equities also saw their largest fund inflows in two years ahead of the Federal Reserve’s Jackson Hole meeting.

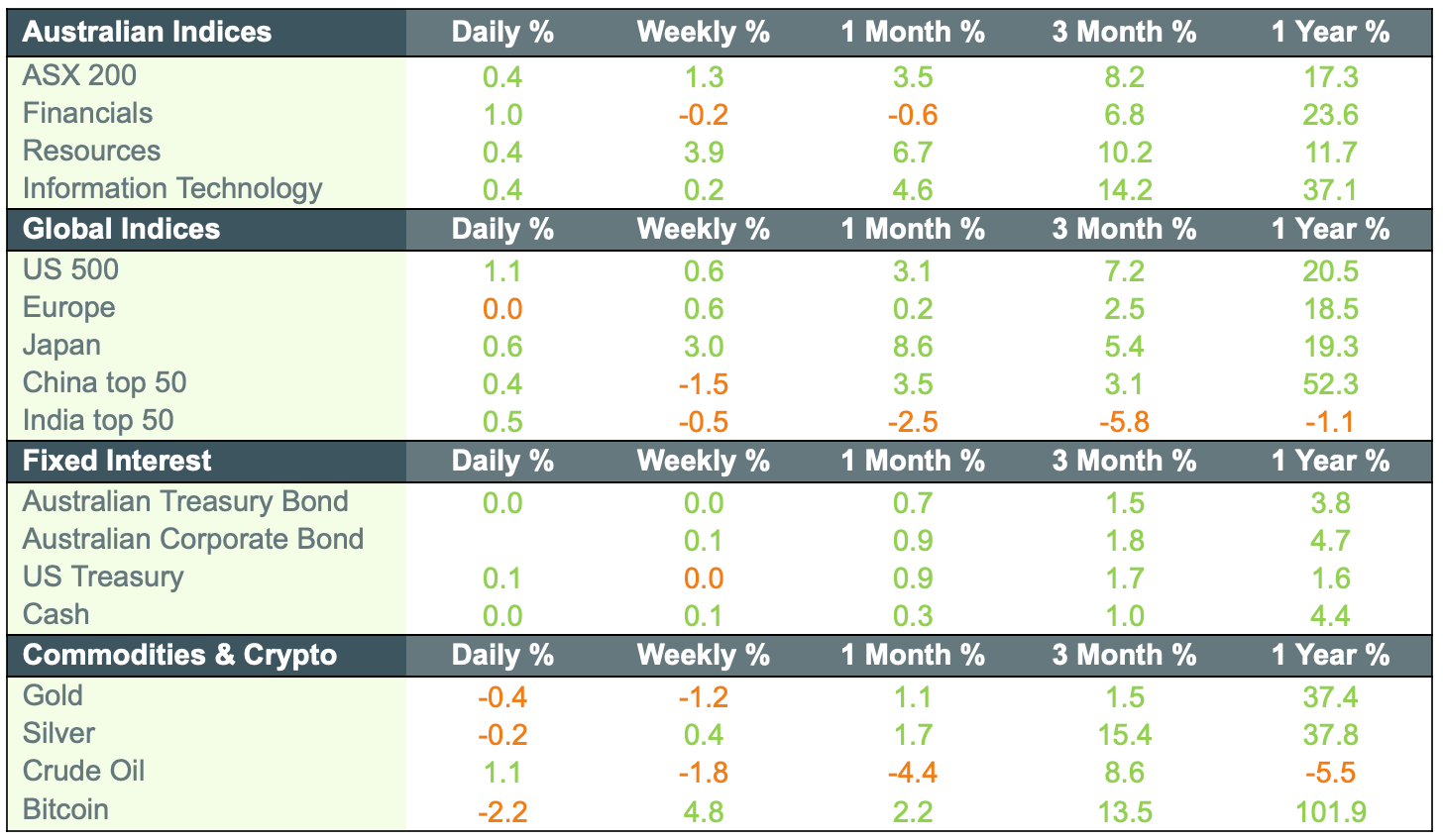

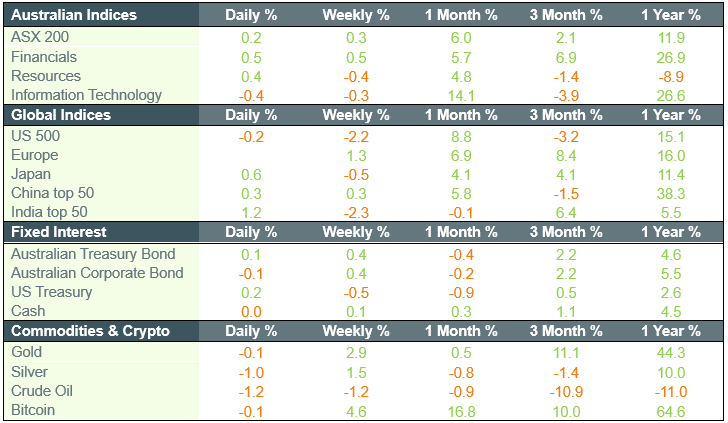

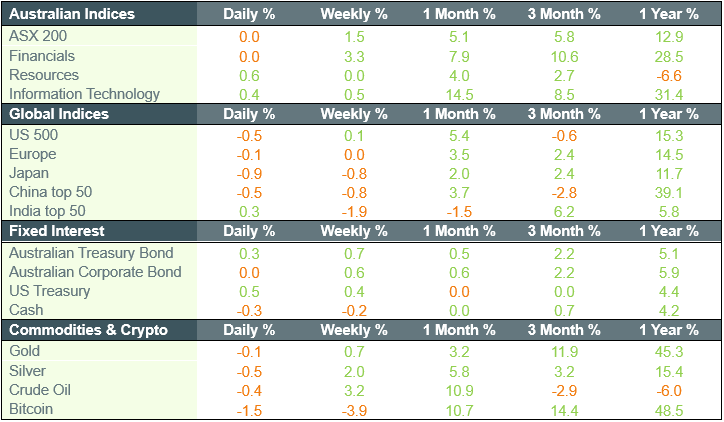

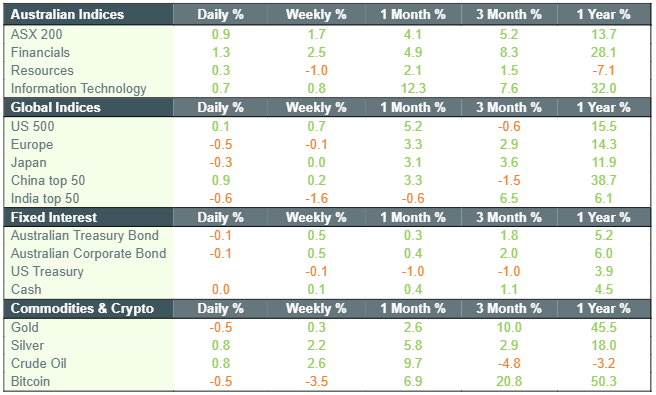

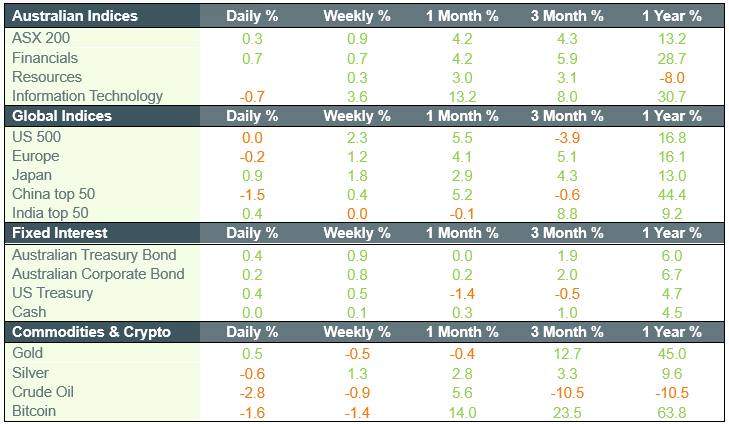

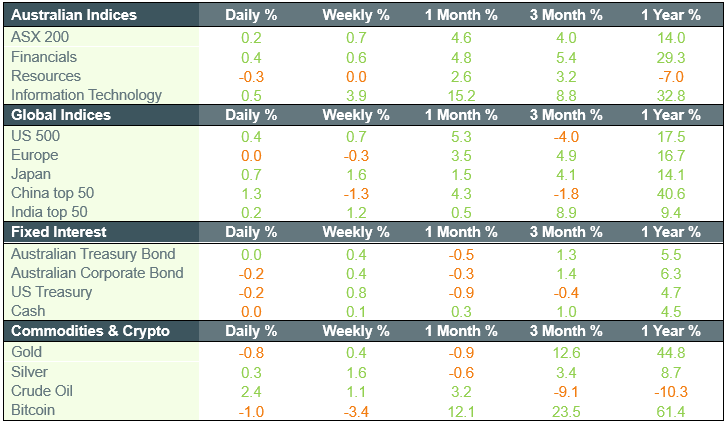

Market movements