Daily Market Update: 28 May, 2025

The key takeaways from the last 24 hours

No Mondayitis for local market

The S&P/ASX 200 Index (ASX: XJO) rose 46.6 points, or 0.6 per cent, to 8407.6 at the close, while the broader All Ordinaries Index (ASX: XAO) appreciated 42.7 points, or 0.5 per cent, to 8,631.5. Six of the ASX’s 11 sectors gained ground, led by information technology, which added 1.2 per cent.

Logistics software heavyweight WiseTech Global Limited (ASX: WTC) rose $2.32, or 2.2 per cent, to $107.07; small business accounting software player Xero Limited (ASX: XRO) was up $2.63, or 1.5 per cent, to $183.57; and hotel operations software provider Siteminder Limited (ASX: SDR) advanced 11 cents, or 2.5 per cent, to $4.51.

The Financials Index was also higher, up 1.1 per cent, led by Westpac Banking Corporation (ASX: WBC), which was up 53 cents, or 1.7 per cent, to $31.78; Australia and New Zealand Banking Group Limited (ASX: ANZ)firmed 40 cents, or 1.4 per cent, to $29.06; National Australia Bank Limited (ASX: NAB) lifted 35 cents, or 0.9 per cent, to $37.75; and Commonwealth Bank of Australia (ASX: CBA) gained $1.46, or 0.8 per cent, to $175.34.

The Healthcare Index was up 0.9 per cent, led by Fisher & Paykel Healthcare Corporation Limited (ASX: FPH), which put on 79 cents, or 2.4 per cent, to $34.12; Pro Medicus Limited (ASX: PME), which surged $3.99, or 1.5 per cent, to $278.59; and sector heavyweight CSL Limited (ASX: CSL), which strengthened $1.94, or 0.8 per cent, to $248.99.

Telstra Group Limited (ASX: TLS) accrued 2 cents, to $4.75.

Farm chemical supplier Nufarm Limited (ASX: NUF) slid a further 14 cents, or 5.6 per cent, to $2.36, retouching an all-time low, having plunged more than 30 per cent in one session last week after downgrading its earnings guidance. The stock is down almost 35 per cent in 2025 and has nearly halved in the last 12 months.

Mixed bag for miners

On the resources front, the big bulk miners pushed higher, with BHP Group Limited (ASX: BHP) advancing 7 cents, or 0.2 per cent, to $38.64; Rio Tinto Limited (ASX: RIO) putting on 4 cents, to $115.25; and Fortescue Limited (ASX: FMG) also up 4 cents, or 0.3 per cent, to $15.58.

Canada-based Capstone Copper Corp. (TSX: CS) spiked 54 cents, or 6.8 per cent, to $8.43, and local copper producer Sandfire Resources Limited (ASX: SFR) added 34 cents, or 3.1 per cent, to $11.36.

Coal miners largely had a good day, with Yancoal Australia Ltd (ASX: YAL) gaining 8 cents, or 1.6 per cent, to $5.24; New Hope Corporation Limited (ASX: NHC) strengthening 5 cents, or 1.3 per cent, to $3.77; and Whitehaven Coal Limited (ASX: WHC) lifting 6 cents, or 1.1 per cent, to $5.53.

But at the other end of proceedings, lithium producer Pilbara Minerals Limited (ASX: PLS) eased 5 cents, or 3.6 per cent, to $1.34; gold miner Evolution Mining Limited (ASX: EVN) shed 28 cents, or 3.1 per cent, to $8.79; rare earths producer Lynas Rare Earths Ltd (ASX: LYC) gave up 20 cents, or 2.5 per cent, to $7.95; and gold producer Ramelius Resources Limited (ASX: RMS) dropped 6 cents, or 2.1 per cent, to $4.91.

US markets rise as trade tempers cool

Returning after the Memorial Day long weekend, the major United States market indices snapped a four-session losing streak, as United States-European Union trade tensions eased on the back of President Trump agreeing to delay tariffs of 50 per cent on the European Union.

The blue-chip Dow Jones Industrial Average (INDEXDJX: DJI) gained 740.58 points, or 1.8 per cent, to 42,343.65, while the broader S&P 500 Index (INDEXSP: INX) climbed 118.72 points, or 2.1 per cent, to 5,921.54.

The tech-heavy Nasdaq Composite Index (INDEXNASDAQ: IXIC) surged 461.96 points, or 2.5 per cent, to 19,199.16, as tech heavyweights such as Tesla Inc. (NASDAQ: TSLA) pushed higher. The electric vehicle maker jumped almost 7 per cent, while NVIDIA Corporation (NASDAQ: NVDA) was up 3.2 per cent ahead of its earnings release, Apple Inc. (NASDAQ: AAPL) gained 2.5 per cent and Microsoft Corporation (NASDAQ: MSFT) rose 2.3 per cent.

European stocks were also higher on better trade news, with Germany’s DAX Index (XETRA: DAX) reaching a new record, up 0.8 per cent to take its gain for 2025 to 21 per cent.

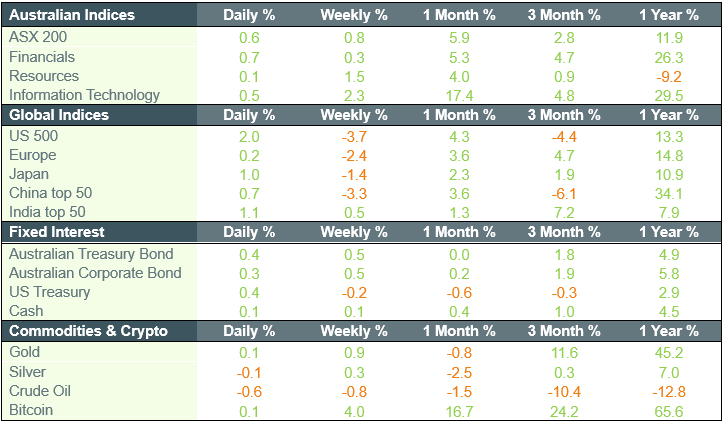

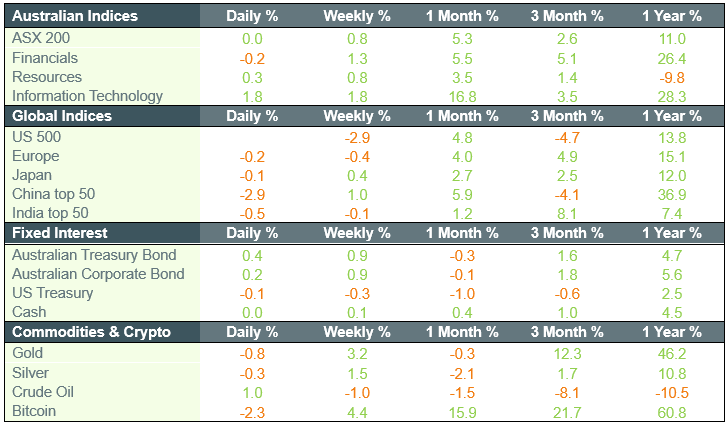

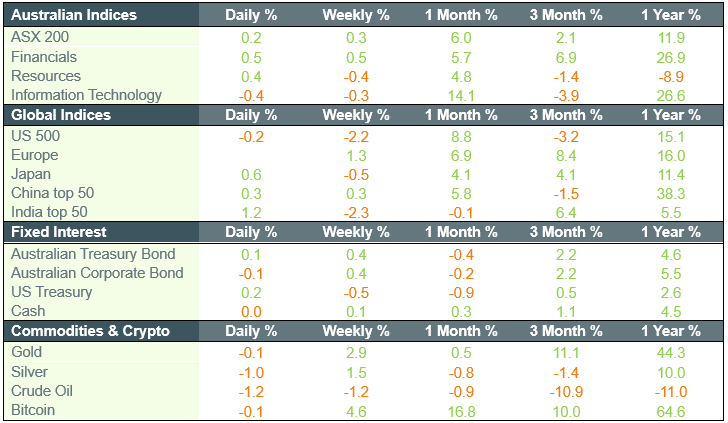

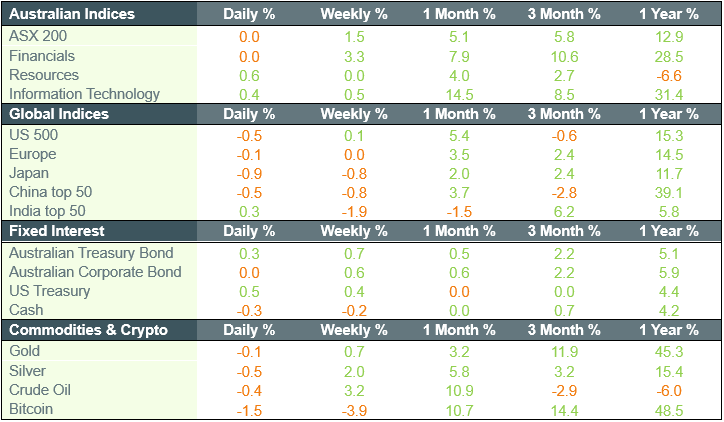

Market movements